Personally, I am in the 12.5% category above, and further, I receive a NET refund from the government. How can this be? I have a family of 6, with a single income. We have a home mortgage. We contribute over 10% of our annual gross income to charitable organizations. I receive the full child tax credit for four children. All in all, it's the "perfect storm" of federal deductions and tax credits. About the only thing I'm not getting, it seems, is the education deductions, because I finally finished up college. In other words, I'm a federal welfare recipient.

There is a problem with this scenario. These are "tax code expenditures", to borrow the phrase du jour, that are supporting social policy, not fiscal policy. I say that the concept of "refundable" tax credits should be abolished. You should not be able to receive a refund larger than your contributions. If the federal government wants to support various social policies or programs, it should explicitly create a budget line item for that action. Do you want to provide support to families in raising their children? Set up a Federal program to do it. Don't hide it in the tax code. Do you want to increase home ownership (as misguided a policy as that might be)? Set up a Federal program to do it. Don't hide it in the tax code. Do you want to increase attendance in institutions of higher eduction (even though trade schools can be just as effective in training someone for a career)? Set up a Federal program to do it. Don't hide it in the tax code.

At the very least, if you are going to provide a tax code incentive, it should be capped. Again, no one should receive a TAX REFUND greater than the amount of taxes paid. It is a TAX REFUND, not a social program payout. If the tax incentive is not sufficient to modify social conduct to your desired ends, then set up a nominated program, that is fund from the general budget.

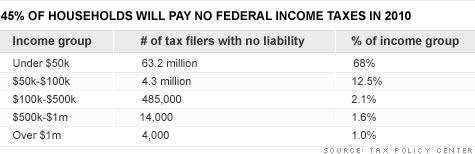

We often hear that we don't have a spending problem, we have a revenue problem. So, you can either try and increase the amount of revenue you're receiving from existing sources, or you can increase your sources of revenue. In a personal budget scenario, this is analogous to asking for a pay raise, or taking on a second job. According to the article:

If most tax breaks were removed, the Tax Policy Center estimates, the percentage of households with no federal income tax liability would drop to 27% from 45%.This provides a double-whammy. It both increases revenues AND decreases spending.

That seems like a no-brainer to me.

No comments:

Post a Comment